Table of Content

You can also check out the details of the deductibles, discounts, and add-on options. If you are placing your home on the market, you can opt for theseller’s warranty. It helps both you and prospective buyers feel reassured about the state of the property.

In addition, warranties have numerous exclusions, as well as dollar limits per repair and per year. One major problem with a home warranty is that it will not cover items that have not been properly maintained. What is considered proper maintenance can be a significant gray area and is the source of many disagreements between home warranty companies and warranty holders.

Are there any waiting periods for a home warranty?

Many realtors and even title companies offer home warranties during the sale of a home, too. When buying or selling a home is a convenient time to purchase a home warranty. Often, home sellers will offer to pay for the first year of a buyer’s home warranty to entice buyers to bite. “The home warranty offered at the time of the real estate transaction typically offers the most comprehensive coverage and price points, so that’s why it’s the ideal time to lock it in,” Bell says. A new homeowner will purchase a home warranty as an added layer of protection when buying a home. They can purchase it through a real estate transaction where they will get a discount if they purchase the home warranty within 30 days of closing.

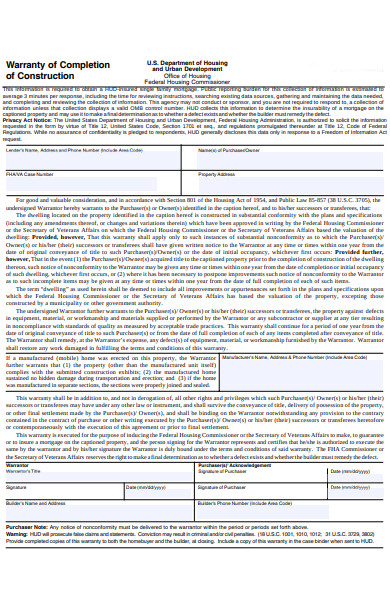

New-construction homes often include limited-time warranties, but be sure to check the terms and conditions. Like homeowners insurance policies, many don’t cover appliances. Even if the structure of your home is still new, it doesn’t mean one of your appliances won’t go up in smoke unexpectedly. So, as soon as the builder’s warranty expires, reassess your coverage, and make sure your major appliances are protected. The same goes for the manufacturers’ warranties on your appliances — when they run out, a home warranty company can fill that gap in coverage. Home warranties are renewable home service plans that provide discounted repair and replacement services for covered household appliances and systems.

What Don’t Home Warranties Cover?

But not everyone thinks home warranty companies are worth the cost. Typically a warranty isn’t necessary with new homes, since most of the appliances are already covered under manufacturers’ warranties. But in general, the older your home, the greater the odds that something’s bound to break, and the wiser it is to get a home warranty. Not all home warranty companies differentiate between newer and older homes in terms of cost, making a warranty an especially cost-effective option if you are purchasing an older home. While homeowners are often required to get homeowners insurance along with their mortgage, home warranties are a fully optional purchase.

Basic coverage starts at about $300 and goes up to $600 for more comprehensive plans, says Bell. “Home warranties provide financial protection from a service provider for homeowners who might be faced with unexpected problems with their appliances,” explainsShawna Bellof Landmark Home Warranty. They can purchase a home warranty at any time on a house of any age, no matter how long they have lived in it.

Top Home Warranty Companies And Average Cost Breakdown

She previously edited home repair and design content at The Spruce and HomeAdvisor. Pay particular attention to the length of specific types of coverage. You’ve opened all your gifts, and now it’s time to open those post-holiday credit card statements. If you were a little too jolly with your holiday spending, here are some tips to help you pay down your credit card debt. Property insurance provides financial reimbursement to the owner or renter of a structure and its contents in the event of damage or theft.

This additional coverage can be especially helpful if your house has a pool, hot tub, well pump or other type of home system. (There is no need to spend time researching dozens of repair technicians.) The home warranty company has a network of trusted professionals. But, are home warranties worth it for both homeowners and renters? Learn more about what a home warranty is, when someone should purchase it and whether a home warranty is right for you . Repairs are an inevitable part of living in a home, regardless if you own or rent one.

What Is a Home Warranty? Peace of Mind for Home Buyers

When you purchase a warranty, the warranty company handles any repairs on covered appliances or systems. You’ll pay a nominal fee for a service call, but the company will take care of scheduling and correspondence, saving you from finding technicians on your own. Further, homeowners insurance protects you from liability if your home suffers damage from catastrophic events such as tornadoes, earthquakes, floods or fires. A home warranty is different in that it covers your systems and appliances rather than the home itself and only applies to breakdowns resulting from normal wear and tear.

The amount you pay will depend on the home warranty provider you choose and your level of coverage. The value of a home warranty will vary from homeowner to homeowner and from situation to situation. Since budgets may be tight and DIY home repair difficult, a home warranty can be especially valuable for the elderly and first-time home buyers. The plan could save your budget in the event a major appliance or home system needs to be fixed or replaced. For a new contract, you can typically purchase a plan at any time but it’s common for new owners to get coverage within 30 days of closing.

To formulate our rankings of the best home warranty companies. This system accounts for a wide range of ranking factors, and we collect data on dozens of home warranty providers to grade the companies on each factor. The end result is a cumulative score for each provider — companies that score the most points top the list.

A home warranty is a contract between you and a company that covers repair costs on selected items in and around your home. Home warranties cover breakdowns due to routine wear and tear, but any damage or malfunction due to neglect, misuse, or natural disasters are typically not covered. In many instances, a home warranty company also helps provide a vetted and trustworthy repair technician for you. A home warranty is worth it for homeowners if they seek the peace of mind it provides regarding their home’s appliances and systems. Typically, when purchasing a newly built home, the likelihood you’ll need a home warranty is slim due to the countless already provided warranties.

Read other third-party customer reviews, such as Yelp and Google Reviews, to get a good idea of what it’s like to work with that home warranty company. If you are a home buyer, you might raise this topic to your real estate agent or mortgage lender to see their suggestions. When you purchase or rent a home, chances are you will be offered a home warranty as protection against costly unforeseen repairs. It sounds like a great idea, especially since the average monthly fee for home warranties isbetween $25 and $50.

When you purchase a home, you can have your real estate agent ask the seller if the property is currently covered by a warranty. If it does not have a warranty, you may be able to negotiate with the current owner and have them purchase a policy before closing. Home warranty cost depends on several factors, including your home’s location, which plan you choose and the plan’s service fee.

Depending on what level of coverage you purchase, most plans will typically cover most major components of large home systems, such as your HVAC, water heaters, plumbing and electrical. Some plans cover appliances such as washers, dryers, refrigerators and stoves. You can also purchase optional add-on coverage for your spa, second refrigerator, swimming pool, pumps, septic systems and more depending on how much you can pay for a home warranty. Before you decide to purchase a warranty, consider whether it’s worth the investment. A home warranty can offer immense benefits to some homeowners, but for others, it may not be worth the cost.

No comments:

Post a Comment